Energy Musings - December 19, 2024

We examine in greater depth the impacts on regional energy markets due to the European wind lull. Not only are countries with more renewables hurting their citizens, their power suppliers are hurt.

Winter, Renewables, And Europe’s Economy – Part 2

In Part 1, we discussed the impact of the recent wind lull across Europe on Germany’s electricity prices, sending them to record levels. Surprisingly, Europe’s need for imported electricity to offset the continent-wide wind lull sent Norway and Sweden’s electricity prices to record levels, too. They were suppliers of surplus electricity, suggesting the broader market has supply issues and economic dislocations. In Part 2, we will examine these issues. Part 3 will deal with Europe’s economic outlook in light of its energy policies.

Europe’s wind lull hurts Norway and Sweden.

Norway and Sweden are blessed with substantial hydropower generation capacity. This cheap power keeps their power prices down. The price shocks in Norway and Sweden were a surprise and are creating political problems and a re-examination of their energy policies.

The price shocks have caused Norway to reconsider the role of its 17 interconnector lines with Europe and whether the country should remain a key supplier of power to nations on the continent. The debate in Norway is destined to become an important political issue in next year’s federal elections. Various political parties want to terminate the lines to Denmark that are up for renewal in 2026 and 2027 and require technical refreshment. One political party even wants to renegotiate Norway’s interconnector agreements with the UK.

Next door, the situation was similar, but the policy reaction was different. In response to the continent’s wind lull, Sweden’s Energy Minister Ebba Bush said, “The government is open to supporting households and businesses if needed.” Her comment came after the shocking jump in electricity prices and was designed to offer comfort to the citizens facing huge power bills.

According to an article in Aftonbladet, electricity prices in southern Sweden were 18,000% higher than in central Sweden when supplies were shipped across the Baltic Sea. The newspaper estimated that the cost of a 10-minute shower in Southern Malmo was over SEK 31 (Swedish kroner), equivalent to $2.85. That same shower in central Sweden Sundsvall cost only SEK 0.17, or $0.02!

Swedish Prime Minister Ulf Kristersson warned, “There will be hard times ahead.” He attributed the difficult future for citizens to the previous government’s decision to shut down several nuclear reactors between 2019 and 2020 as part of an energy policy shift towards greater reliance on renewable energy. In his view, citizens are facing rising electricity prices because renewables are more costly than fossil fuel power.

Today, Sweden operates three nuclear plants with six reactors. They account for nearly 30% of Sweden’s electricity. The largest plant has three reactors with 3.3 gigawatts (GW) of capacity and produces almost half of the country’s nuclear-generated power.

Energy Minister Bush told Swedish broadcaster SVT, “I’m furious with the Germans. They have made a decision for their country, which they have the right to make. But it has had very serious consequences.” Those consequences come from the impact on electricity prices in countries watching their surplus power be sucked out of their grids, leaving parts of their countries having to pay high prices for their power.

The rush by European countries to shift their grids from fossil fuels to renewables is causing electricity prices to soar. They find intermittent renewable energy sources costly, mainly because they require backup power ready to supply electricity when the wind stops blowing and the sun doesn’t shine. This backup power results in the duplication of the generating capacity of the nation’s grid. That costs money.

The European problem stems from the Flow-Based Market Coupling system. This is an EU electricity market mechanism designed to optimize cross-border electricity flows by prioritizing demand across the entire European grid rather than focusing on national needs. The system was introduced in Sweden in October 2024. It was designed to broaden the continent’s power-sharing efforts and make them more efficient. It has had the impact of raising electricity prices in southern Sweden.

Sweden has a north-south power connection problem similar to that in Norway. Correcting that weakness is difficult because of both countries’ terrain, population centers, and electricity-generating capacity. The populations are located in the south, with inadequate electricity generating capacity. There is little population in the north but all the hydropower generation. Connecting the two regions with wires requires going over mountains, which is expensive.

In mid-2023, when the current Swedish coalition government came into office, the parties agreed to a new energy policy. The country’s energy goal has been switched from “100% renewable to 100% fossil-free." This set the stage for a new plan that focuses on more nuclear power, which is fossil-free power, to help the country meet its projected doubling of electricity demand by 2045.

The plan details were announced this summer following a three-month review of Sweden’s future energy needs and the challenges for nuclear power by the newly created new-build coordinator. The report outlined the broad policy direction for new nuclear power in Sweden.

“In concrete terms, this means that the conditions need to be prepared to enable 2500 MW of new nuclear power capacity by 2035. By 2045, this could mean a total of about 10,000 MW of new nuclear power capacity.” Sweden currently operates 6,885 MW of nuclear generating capacity. The nation will have doubled its capacity if all the planned new nuclear power is installed.

To reach the targets, the current laws limiting the number of reactors in operation to 10 and restricting new reactors to existing sites are being changed. Furthermore, provisions will allow for the construction of small modular reactors. The government is overhauling nuclear construction regulations and boosting nuclear engineering and research spending. The government has determined it must become a financing and guarantee source for these new plants to encourage financial institutions to back their construction.

It will be interesting to see if other European countries adopt policies similar to Sweden’s to promote nuclear energy. Sweden was one of 22 countries signing a declaration at COP 28 to advance the aspirational goal to triple nuclear power capacity by 2050. While the media focused on the UN’s COP 28 conference concluding pronouncement that emphasized transitioning away from fossil fuels and tripling renewable energy capacity, the document also included nuclear in the Global Stocktake. This was a massive victory for nuclear power. The inclusion reflects how much perspectives have changed for nuclear power commented International Atomic Energy Agency Director General Rafael Mariano Grossi.

Understanding the shortfalls of renewable energy.

The early November cold weather and wind lull was the first shock of the winter season to Germany’s grid. A repeat happened last week. Electricity prices soared in consumer Germany and supplier Norway, putting the interconnector lines into play in next year’s Norwegian elections. Germany’s power supply sources are similar to those of the European Union.

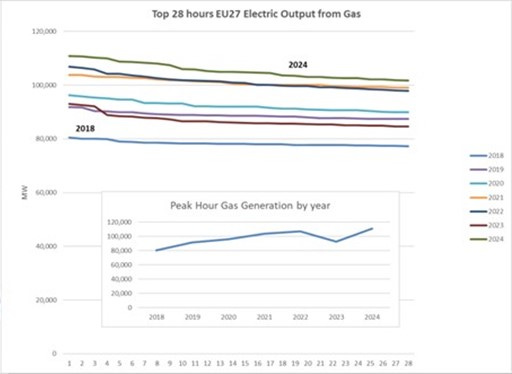

The Electric Power Research Institute (EPRI) prepared the following chart. The top chart shows the top 28 hours each year that relied on electricity generated by natural gas. It shows that 2024 has seen the highest amount of electricity generated from natural gas in each case.

The bottom chart shows the peak hour of each year that relied on natural gas generation. It shows that since 2018, more electricity has been generated from natural gas every year, except for the unseasonably warm winter of 2023.

Natural gas is critical for Germany’s grid performance.

Another chart from the EPRI shows Germany’s wind and solar output for 15-minute intervals each month from 2015-2023. It also shows the installed capacity, which is interpolated between the respective year-end installed capacity data. The chart also shows the monthly maximum, average, and minimum 15-minute output. The data reflects only the wind and solar power connected to the German grid and not any solar power behind the meter.

The low capacity of renewables is evident and a problem.

The average monthly 15-minute minimum interval for the 9 years is about 1.2%. The EPRI official commented that this low average input makes it difficult for grids to balance supply and demand between 50 and 60 Hz. That demonstrates why grids with high wind and solar capacity require substantial backup power from natural gas plants.

People who looked at the chart were surprised at how slowly the monthly maximum output rose compared to the total installed capacity. That led to a comment about the behind-the-meter capacity included in the total while its output is not included. Since that measure is primarily solar capacity, the output likely would not have had a material impact on the average output calculations.

Another energy expert noted that the average wind and solar capacity factor (output as a percentage of total installed capacity) appeared to be about 14%. As solar’s capacity factor is among the lowest of any renewable energy source, including the behind-the-meter output in the calculation would not dramatically boost it.

Here is another chart showing the impact of the cold weather and wind lull on Europe’s mix of power supplies.

Gas and coal come to Europe’s rescue.

Given the chart’s source, S&P Global Commodity, the data should be considered accurate. The message from the chart is what is essential. Energy economist, commodity trader, and author of The Unpopular Truth: about Electricity and the Future of Energy Lars Schernikau pointed out the key conclusions. The total generated power of France, Germany, Italy, Spain, and the UK at the end of 2024 is about the same as at the beginning of 2020. This reality is stark as wind and solar installed capacity increased by almost 40% to 350 gigawatts. Furthermore, the combined coal and natural gas output is about the same as at the start of 2020.

Schernikau notes that each additional solar panel or wind turbine creates less value than the previous one. Each additional kilowatt-hour of power generated by solar or wind has less value than the previous one. In his view, the data suggests that these countries are saturated with renewable energy. Still, based on their plans for adding more capacity, they either do not understand the data or choose to ignore it at a cost to their citizens.

The Scandinavian threats to overhaul their agreements to supply surplus power to European nations mark a watershed moment. Governments that have invested in grid capacity, capitalizing on their natural resources, question why they have agreed to subsidize people with different agendas. The moral imperative of shared suffering occasioned by the Flow-Based Market Coupling may receive greater scrutiny.