Energy Musings - December 16, 2023

November marked two months of negative Energy sector performance for the first time since 2021. Weak oil prices have depressed interest in Energy stocks and this is unlikely to change soon.

Energy Sector – Either Feast or Famine

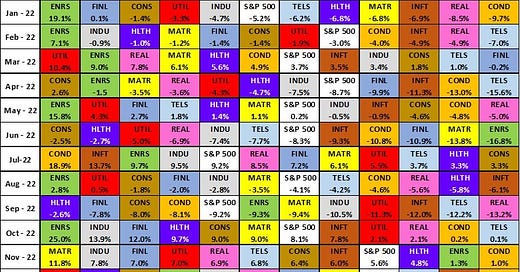

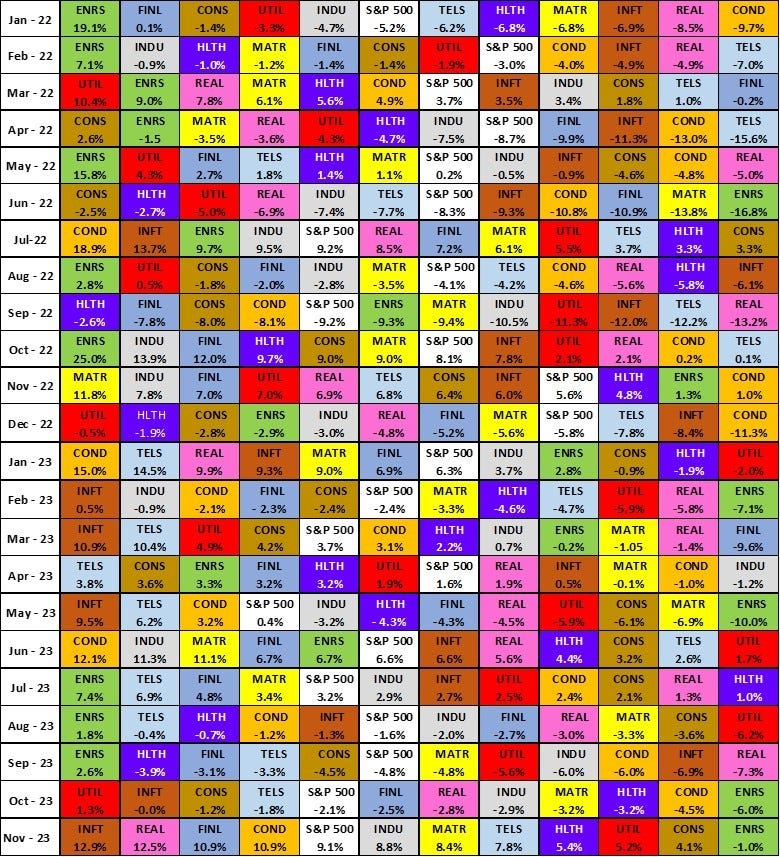

Our Southeast Asia trip during late November and early December prevented us from updating our monthly Standard & Poor’s 500 Index sector performance chart. We knew before heading out of town that Energy was experiencing another bad month – the second in a row. Surprisingly, that hasn’t happened since the summer of 2021.

The poor November stock market performance was not a surprise given the weakness in crude oil prices marked by OPEC+ members continuing to extend their temporary production cuts because they fear growing oil supply overwhelming weaker than originally anticipated oil demand. Last Wednesday, WTI dropped by nearly three dollars a barrel to $68.61 reflecting the expectation that oil supply would continue putting pressure on producers to cut output further. Wednesday’s closing price was the lowest since June 27th.

Surprisingly, oil prices rebounded Thursday and remained above $71 at Friday’s close. This rebound came despite money managers cutting their net long positions for both WTI and Brent to “the lowest in exchange and regulatory data going back to 2011.” The record net low position was the result of traders making short-only bets at the highest level in nearly four years. Support for oil trading has waned in recent months as higher interest rates make it more expensive for crude oil traders to hold positions. Coupled with the rhetoric heading into the UN’s COP28 environmental conference in Dubai that the world needed to “end the fossil fuel era,” sentiment surrounding oil is extremely negative.

Despite the browbeating and arm-twisting, COP28 delegates were unable to agree to end the use of fossil fuels as so many environmental representatives were demanding. COP28 was forced to go into overtime to produce an agreement satisfactory to the nearly 200 member countries. This was the second of the last three COP conferences that needed overtime to reach an “unsatisfactory” agreement. COP26 was expected to agree to end the use of coal, which has not happened.

Yes, people are calling the COP28 agreement for “transitioning away” from fossil fuels historic, but it will likely prove as ephemeral as the pledge to end burning coal. Why? Because the world is suddenly realizing it needs fossil fuels to function and all the green energy in the world isn’t going to keep economies functioning. The International Energy Agency, which dramatically called for a peak in global oil use within the next several years, is now rushing to revise its 2024 oil consumption estimate higher and suggesting future oil use will rise, too.

As for coal, while COP28 was winding up, an important deal was announced by Viet Nam, the world’s 10th largest coal user for generating electricity, which agreed to import more supply from neighbor Laos to satisfy its rapidly growing power needs. Viet Nam is merely following the pattern of China and India which are building more coal-fired power plants despite adding significant renewable energy resources. Indigenous coal reserves are important for sustaining large coal-mining employment in these countries and ensuring cheap power is readily available for the manufacturers who are moving plants into these economies.

For Energy stocks, their dismal (-1.0%) performance in November, following a very weak (-6.0%) October, leaves the sector with a -1.3% return for the year so far. Surprisingly, Energy is not the worst-performing sector year-to-date, as it has still outperformed Consumer Staples (-2.1%), Health Care (-2.2%), and Utilities (-8.8%). So far, the first half of December has not shown Energy reversing its weak November performance. Given falling oil prices and investor expectations that the Federal Reserve is done hiking interest rates and will begin cutting them starting as early as March 2024, equity flows are moving into those market sectors that stand to benefit from lower interest rates and a “soft” economic landing.

November’s performance for the S&P’s Energy sector was the first two-month down period since the summer of 2021.

Energy stocks have demonstrated high price volatility this year. The chart below shows the performance of the S&P 500 Energy sector ETF (dark blue) compared to that of the S&P 500 Index (light blue). We see how the energy bull market of 2003-2015, ignoring the Financial Crisis of 2008-2009, had Energy outperforming the overall market. However, the battle for oil market share unleashed by Saudi Arabia in late 2014 crashed oil prices and led to serious financial problems for oil and gas companies including hundreds of bankruptcies, resulting in the performance gap between Energy and the S&P 500 closing.

Energy’s heyday was 2003-2014, but the recovery in recent years has been impressive and sets the stage for another industry cycle.

While Energy struggled to regroup and recapitalize, the sector went nowhere from 2016 to 2020, at which point the Covid outbreak destroyed oil demand and briefly sent oil prices into negative territory. The economic rescue operations of global central banks that involved slashing short-term interest rates to near zero and pumping huge amounts of liquidity into financial markets along with substantial fiscal stimulus by governments produced a rapid recovery. As many countries were involved in economic lockdowns as a tool to fight Covid, the extra money flowing to citizens spurred consumer spending that helped drive the overall stock market higher.

The rapid recovery of economies, coupled with the embrace of financial discipline by the historically spendthrift oil and gas industry, quickly brought a closer balance between oil supply and demand. With market balance, oil and gas prices recovered and then soared when Russia and Ukraine went to war in early 2022. Expectations were for the loss of substantial amounts of Russian oil and gas supply, so the metronome for sentiment quickly ticked from glut to shortage within 24 months.

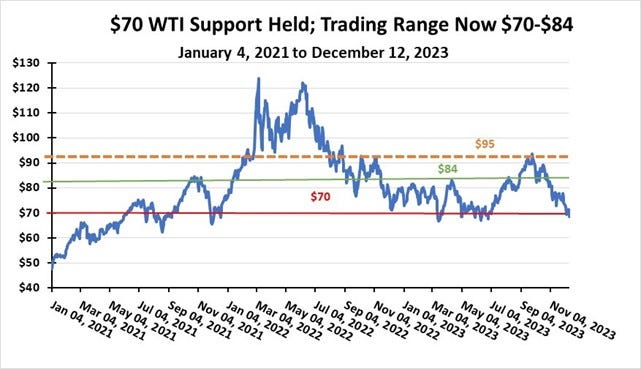

Oil prices remain rangebound but that is probably a good thing for the health of the petroleum industry.

The chart above shows the history of WTI futures prices since the start of 2021. The global economic recovery following Covid drove oil prices steadily higher during 2021 leading to the spike in early 2022 with the outbreak of the Russia/Ukraine conflagration. Europe’s energy shortage and the enforcement of strict sanctions against Russian oil and gas sales kept oil prices elevated and volatile as markets focused on negative scenarios for supply. As the bad outcomes failed to emerge and China’s economic recovery was delayed, weaker oil demand undercut prices as supplies grew faster than predicted in response to the earlier high oil prices and overwhelmed demand. OPEC+ was forced to act to stop falling oil prices by cutting production.

For most of last winter and through the spring of 2023, oil prices traded within the $70-$80 a barrel range. Prices were range-bound because of fears of an economic recession that would cut demand. As recession fears waned, oil prices strengthened with OPEC+ holding to its production cuts and oil industry capital spending holding steady. What has surprised the oil market has been the relentless growth in U.S. output despite industry spending holding steady and the rig count barely rising. Well productivity has surprised to the upside. For the overall oil market, the growth in supply from Brazil, Canada, and Guyana, coupled with Libya’s production holding up and Venezuelan output rising as well as Iran’s exports growing. In other words, supply is growing faster than anyone expected, and without surging demand, the oil market is reflecting a weaker pricing environment. That helps explain the recent drop in oil prices.

What can we expect in the near term? As oil prices are likely stuck in the lower end of a trading range, but at a level that continues to support profitable operations, it is likely Energy stocks will continue to struggle in the face of fears of an oil glut driving prices lower. At the same time, the stock market is being lifted by investor expectations for lower interest rates in 2024. Lower oil prices are helping to keep the economic recovery going as they contribute to lowering inflation. However, few market or economic commentators have acknowledged the role of the U.S. oil industry in boosting the global economy by depressing inflation. At some point that benefit will end, unless technology continues to allow oil companies to harvest greater output from wells drilled in mature basins. If technology doesn’t sustain production, we are set to restart the commodity cycle which will be linked to the higher prices driven by a tightening oil supply/demand balance. In our opinion, the petroleum cycle has not been truncated, only paused.

It is also important to note that investors and traders partially shape the negative oil market sentiment by completely ignoring geopolitical risk. Although the Hamas/Israeli battle has not exploded into a region-wide war, that risk still exists. Additionally, China/U.S. tensions remain high. Could an accidental encounter happen? And the Russia/Ukraine war has become a stalemate. As it drags on, divisions within the European Union and in the U.S. political arena are becoming evident. Finally, there is the newest geopolitical flashpoint: Venezuela’s attempt to annex the oil-producing region of Guyana. These international geopolitical tensions could be inflamed by the large number of political elections in the upcoming year. It is possible to envision significant country election upsets further disrupting the global political balance.

Although the current economic and political environment argues for continued low oil prices and weak Energy stock performance, forces and potential events exist that could derail that scenario. As long as the world’s population grows and people seek higher living standards, energy in all its forms will experience increased demand. The long-term pricing dynamic for energy is upward, and it will drive inflation up and force governments and central banks to respond. How and when this scenario unfolds is uncertain, but history has taught us that energy markets can change dramatically quickly, and usually due to an unexpected event. That prescription still holds today.