Energy Musings - August 2, 2024

For July, the S&P 500 Energy sector's performance was much better than its prior two months results. This was not surprising given higher oil prices for most of the month.

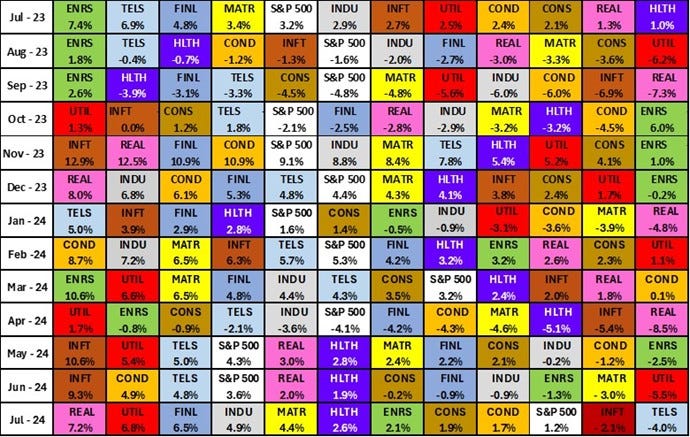

July Monthly S&P 500 Sector Performance

After two months at the bottom of the Standard & Poor 500 sector performance ranking, energy climbed closer to the middle. That was not a surprise given that oil prices traded in the mid-$80s a barrel for the first three weeks of the month, up from the high $70s in June. However, July’s closing days were not helpful for energy stocks as oil prices dropped, falling below $75 a barrel on July 30. Weak oil prices equal weak energy stock prices.

On the last trading day of July, oil prices jumped by more than 4% following reports that Israelis killed Ismail Haniyeh, a leading Hamas official involved in the Gaza cease-fire talks, while he was in Tehran attending the installation ceremony for the new Iranian president. The news sparked fear of a spreading of the Israel-Gaza war because less than 24 hours earlier Israel had retaliated against a Lebanon-based Hezbollah missile attack that killed 12 Druze children. The Israelis assassinated Hezbollah’s most senior military commander in an attack in the capital city, Beirut.

The standard playbook to counter rising Middle East tensions calls for traders to buy oil futures contracts, bidding up their prices. The price rise was further supported by positive comments from Federal Reserve Chairman Jay Powell that the long-anticipated interest rate cut “was on the table” in September. That was music to investors’ ears. An interest rate cut would boost economic activity and help oil demand. The Dow Jones average closed up 100 points in response to Powell’s comments. The tech-heavy Nasdaq index soared 530 points, a 2.8% gain. Lower interest rates spur economic growth and boost high-tech stock valuations, thus the reason for the Nasdaq move.

Energy moved from the bottom of the sectors to the middle in July helped by higher oil prices.

When one examines the July performance of S&P 500 sectors, it is clear the month was impacted by a growing sentiment that interest rate cuts were coming soon. Sectors such as real estate, utilities, and financials, all hurt by high interest rates, were top performers last month. Industrials, materials, and energy, also subject to improving economic conditions, and hurt by high interest rates, also did better. Given this shifting economic environment outlook, it was unsurprising to see that the information technology and telecommunication sectors that had been topping the performance rankings for the prior two months were at the bottom of the July ranking.

As July’s market performance was ending positively, the interest-rate-cut high was erased by economic figures released on August 1. They were poor, but the stock market was also hurt by leading information technology company earnings which fell short of investor expectations.

The market sentiment narrative shifted. Interest rate cuts would likely be driven by a weakening labor market and a whiff of recessionary conditions. In other words, rates need to be cut to stimulate a rapidly weakening economy, something not on investors’ radar screens.

As the stock market dropped sharply Thursday, interest rates also fell. The 10-year Treasury bond yield fell below 4% for the first time since February as the money pulled out of stocks piled into the bond market. That money flow bid up bond prices and correspondingly dropped interest rates.

Where does the stock market go from here? It depends on future economic data releases and geopolitical developments. The recent history of oil prices may be instructive of what the economic pattern may be for the balance of 2024.

The oil price cyclicality may signal that all the economic and interest rate data may fluctuate for a while without providing direction.

Since the fall of 2022, oil prices have been locked in a narrow trading range. Within that range, oil prices have cycled up and down. Oil prices are seeking direction just like the economy. We get positive and then negative economic data. Friday was an example. Employment data disappointed and the unemployment rate ticked higher suggesting more labor market weakness. Interest rates fell further as move flows into the guaranteed return of the bond market versus the risky near-term stock market outlook took control of financial markets.

Events likely will cause oil prices to break out of their tight trading range. However, there is no guarantee anything will happen soon, nor do we know which way they might break. Does the Middle East explode into another protracted war like Russia-Ukraine? Could that mean global oil supplies are disrupted? Might we be heading into a recession that will cut oil demand?

Geopolitical questions also weigh on oil prices, the stock market, and bond yields. Will ending the Biden presidency embolden U.S. enemies to capitalize on our political weakness? Does the Federal Reserve aggressively cut interest rates to prevent a recession? But could that spur inflation rather than economic growth? Does the election outcome matter? Lots of questions but no answers.