Energy Musings - April 9, 2024

The transition from internal combustion engine vehicles to EVs is continuing but at a much slower pace than proponents, government bureaucrats, politicians, and auto executives expected. Why?

The EV Revolution At Stall Speed

In 2024, the electric vehicle (EV) revolution was expected to be in high gear heading toward the Biden administration’s goal of electrifying the domestic auto fleet by 2050. The Biden administration’s fleet electrification push is driven by its desire to be seen as a global leader in fighting climate change and meeting the objectives of the Paris Climate Accord.

Last year, the Environmental Protection Agency proposed new federal vehicle emission standards for light-, medium-, and heavy-duty vehicles commencing with model year 2027 and extending afterward. In the April 12, 2023, press release announcing the new rules, the EPA stated:

“The proposed standards are also projected to accelerate the transition to electric vehicles. Depending on the compliance pathways manufacturers select to meet the standards, EPA projects that EVs could account for 67% of new light-duty vehicle sales and 46% of new medium-duty vehicle sales in MY 2032.”

The EPA further noted that it projects the new rules would result in a 56% cut in “projected fleet greenhouse gas emissions target levels compared to the existing MY 2026 standards.” For medium-duty vehicles, the proposed rules would reduce emissions by 44%. The projection sent up red flags for many transportation sectors that would be impacted, and the public began to worry about how fast the world they knew would be changing.

Spring 2023 was a euphoric environment for EVs. The government was pushing them and it had the domestic auto industry on board with the transition. The Biden administration had secured $7.5 billion to fund the construction of 500,000 EV charging stations needed to facilitate the EV transition. This was in addition to the massive amounts of money being made available to domestic auto companies to build new EV battery plants and EV assembly facilities.

Plenty of money was available to dull the financial pain of buying an expensive EV. The government erected rules restricting the EVs eligible for these purchase subsidies depending on their “local” content. This was a sop to the domestic auto companies, while hopefully, it provided stimulus for developing local supply chains. Local for EVs meant in North America to comply with the North American Free Trade Agreement. It also helped American auto companies with assembly plants in Canada and Mexico. All the ingredients were in place for an EV boom.

Everything had been done to promote the optimistic EV forecasts. Forget that merely announcing plans, and even getting tons of cash to throw at the industry, the reality is these transitions take time – lots of time given the need to build a charging infrastructure and open mines and mineral processing plants to supply the materials for making EV batteries. When looking at recent sales charts it was easy to project an acceleration in the trajectory upward and to the right.

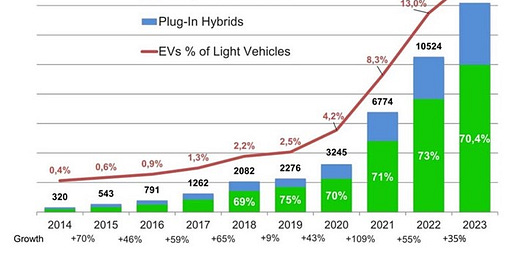

While the chart shows EV sales continuing to increase, the pace of the gains is slowing.

In January, EV-volumes.com wrote about the EV market’s health and posted the chart above. We found the following quote from the article interesting.

“Media reporting that EV adoption is in reverse is not evident in our monthly tracking. Global deliveries of BEVs and PHEVs increased by 3.66 million units over 2022 and all monthly sales were between 8 % and 52 % higher than in the year previous.”

First, we had not read comments about EV adoption running in reverse. There have been many observations about the pace of EV sales slowing. Other articles documented the growing numbers of new EVs sitting in inventory and disgruntled dealers demanding help from their manufacturers. These pressures caused auto manufacturers to reassess their planned EV investments, current vehicle output, and future transition plans. Those actions were dismissed by the government and EV cheerleaders who brushed off the problems as temporary blips on the road to EV nirvana.

However, a key point was buried in the data ev-volumes.com tracked. It was focused on “deliveries of BEVs and PHEVs.” Deliveries are different from sales. A recent Financial Times article about the health of the EV market noted information from an “auto investor” who has collected data from EV suppliers and forecasters. The investor notes that the global auto industry manufactured 10.5 million EVs last year and expects to produce 13.5 million in 2024. Based on current projections, 2025 EV output should increase to 18 million units, 70% growth.

However, as the auto investor noted, the same data sets show EV sales in 2023 totaled 9.5 million units and this year is estimated to be only 9.8 million. The difference between EVs manufactured and sold is inventory. The figures suggest the auto industry added 700,000 EVs to inventory in 2023, which could swell by 3.7 million vehicles this year. Such a projection should be ringing alarm bells in auto company executive offices.

A chart of quarterly deliveries for Tesla and BYD, the giants of the global EV industry, reflects the challenge the entire industry faces. With strong 4Q2023 sales, BYD surpassed Tesla as the world’s largest EV manufacturer. BYD not only dominates its home market of China, the world’s largest EV market, but it is expanding into Europe and North America.

The implication of BYD’s growing market muscle was captured in a comment from an auto company executive speaking to the author of the Financial Times article.

“As one senior executive at a global auto company told me, if the Chinese sell an EV that is just as good as a western car, but cheaper, that is one thing. But if they sell a better car that also undercuts the west, it’s impossible to catch up.”

That sentiment captures the fear of Detroit auto executives and why Treasury Secretary Janet Yellen is in China today urging the Chinese not to use their “surplus” manufacturing capacity to upset global markets. If you want to be our friend, reign in your manufacturers – especially those producing green energy products – like EVs and solar panels. Of course, we are happy to have your lithium and other rare earth minerals to build those products ourselves.

In 1Q2024, Tesla reclaimed the EV crown as its 386,810 EV deliveries, down 20% from 4Q2023 and 8% below the same quarter last year, outperformed BYD. However, Tesla’s sales were declared “an unmitigated disaster” by Wedbush analyst Dan Ives, one of Wall Street’s biggest bulls on Tesla’s stock. Another auto analyst, Tom Narayan of RBC Capital Market commented that Tesla sales results “suggested a sharp deterioration in growth” in the U.S.

The giants of the global EV industry - BYD and Tesla - are trading market leadership positions.

Legacy auto manufacturers reported mixed results. Ford Motor Company sold slightly over 20,000 EVs in 1Q2024, up 86%. But General Motors saw its EV sales fall by about 20% in the quarter. These mixed results suggest that Narayan’s observation about EV sales slowing may be on the mark.

Tesla just announced it was abandoning, at least for the time being, the development of its $25,000 EV model. It was envisioned to be available by 2025. Does this suggest that Tesla executives believe building a car profitably at that price point is impossible?

Ford has announced it is delaying the launch of a new three-row electric vehicle, which it believes will give the EV market time to develop. Ford has been struggling with its EV development plans as it continues to lose billions in its effort, thereby forcing the company to slow its EV investments. Jim Farley, Ford CEO, said, “We are committed to scaling a profitable EV business, using capital wisely and bringing to market the right gas, hybrid and fully electric vehicles at the right time.” This CEO wants to align his business strategy with auto market dynamics driven by customers.

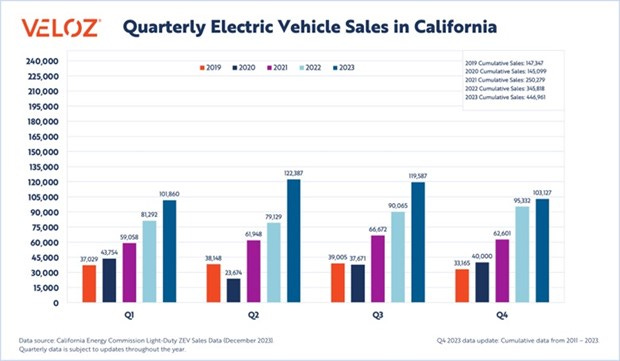

Interestingly, the data for quarterly sales of EVs in California – the American capital of EV worship – shows that they peaked in 2Q2023, which happened to coincide with the announcement of the EPA light-duty vehicle emissions rule proposal. Was it a coincidence or the start of a buyer revolt? Maybe there are other issues impacting EV buyers and their sudden purchasing slowdown.

California EV sales by quarter show that they peaked in 2Q2023 and declined sequentially for the next two quarters.

According to a new survey from Gallup, 7% of Americans report they own an EV. That is up from 4% in 2023. While ownership is up, there was “an equal delink in the percentage saying they are seriously considering buying one, from 12% to 9%.” That has to be discouraging for domestic auto manufacturers. Even more discouraging is that fewer Americans say they might consider buying an EV at some point in the future. That view fell to 35% from 43% in 2023.

The Gallup survey was taken during March 1-20. Overall, less than half of adults, only 44%, “now say they are either seriously considering or might consider buying an EV in the future.” Their interest is down from 55% in 2023. The results of this survey support American EV manufacturers’ decisions to slow EV investments and the introduction of new models.

The survey also flies in the face of the author of the ev-volumes.com article that stated their data doesn’t show a reverse in EV adoption. He should be careful of the fact that his firm is collecting past data, which was driven by an entirely different and highly optimistic narrative about EV adaptation.

The author’s narrative is reflected in the document explaining the final EPA vehicle emissions rule that slows down the EV sales growth while still arriving at the target of having two-thirds of new light-duty vehicle sales in MY2032 be electric. The EPA’s document has several pages quoting from news stories and forecasts about how bullish everyone is about the EV revolution. Of course, all those articles were from 2021. The report did acknowledge some issues were slowing down the pace of the revolution, but not derailing it – at least not yet. The EV transition struggle will continue and we will be watching and commenting.