Energy Musings - April 22, 2024

The global vehicle market has many issues. We examine some of the interesting ones that are reshaping the global market. The electrification effort struggles to recover from its lost momentum.

EVs, Toyota, 4Runners, Tesla, and Buses

April has delivered a year’s worth of news about the health of the global vehicle market. While economies do not depend on the industry’s health, some countries are more impacted than others. The bigger vehicle market story is about the pace of the transition from internal combustion engine vehicles (ICE) to battery electric vehicles (BEV). This is a mandated transition predicated on government clean energy agendas and is considered critical for nations to reach Net Zero emissions.

The European data for March showed a weakening vehicle market. According to the European Automobile Manufacturers’ Association (ACEA), European Union (EU) new car registrations fell 5.2% from a year earlier. While March was the worst monthly comparison, it continued a trend of slowing year-over-year growth. January sales increased by 12.1%, while February sales grew by only 10.1% before sales collapsed in March.

All four of the largest EU members ‒ Germany (‑6.2%), Spain (-4.7%), Italy (-3.7%), and France (-1.5%) – experienced declines in March. The first quarter monthly growth patterns were similar for each country. Overall, for the first quarter, EU auto registrations increased 4.4%.

If we expand the European vehicle market to include the U.K., the EU, and the European Free Trade Association – Iceland, Liechtenstein, Norway, and Switzerland – we can track the health of the continental market. For the quarter, total vehicle sales rose 6.0%. The entire continent experienced a similar slowing in the monthly growth comparisons - +15.4%, +10.2%, and -2.8%.

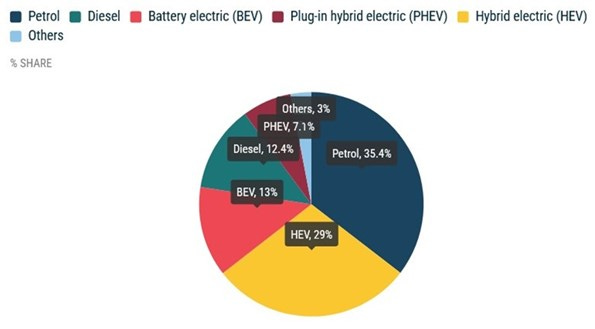

With a slowing European vehicle market, a critical issue becomes the shifting mix of vehicles purchased and the implications for meeting various national net zero emissions targets. Below is what the EU vehicle mix was in March. However, when we consider the March 2023 mix, BEVs (13.9%) and PHEVs (7.2%) were lower, while HEV share (24.4%) increased. The data reflects similar trends as in the U.S. and China – BEV share down and HEV share up.

The mix of vehicles sold in the first quarter of 2024 in the European Union shows how HEVs have overtaken battery-powered EVs.

Interestingly, when we examine the vehicle mix for a combined EU, EFTA, and UK market, the BEV share fell from 15.5% to 14.2%. The PHEV share rose by 0.2% to 7.2%, while the HEV share grew from 25.8% to 30.6%. This is interesting as the expanded market adds Norway, the world leader in BEV share of new vehicle sales, and the U.K. which has also experienced rapid BEV growth. HEVs are selling well in many countries.

A key question facing the electric vehicle market is what March sales patterns may mean for the rest of the year. For the month, BEV registrations declined by 11.3% to 134,397 vehicles but for the quarter sales were 332,999, a 3.8% increase from the prior year. The ACEA suggests the March decline reflected the broader vehicle market downturn. The March decline dropped the BEV market share to 13.0% from 13.9% a year ago. Showing the wide range of market dynamics, two of the EU’s largest BEV markets – Belgium (+23.8%) and France (+10.9%) ‒ had healthy sales gains. But Germany’s market collapsed by 28.9%.

The health of the HEV market in March was notable. Sales were 299,426 units, up 12.6%. France (+29.6%) and Italy (+8.3%), two of the three largest HEV markets, posted healthy gains in a shrinking vehicle market. Surprisingly, Germany’s sales only decreased by 0.3%. Compared to the nation’s BEV sales drop, HEVs barely declining suggests buyers were opting for the least expensive electric vehicles.

EVs are experiencing similar buyer resistance. The charging issues along with range anxiety and EV cost have buyers opting for HEVs as better electric alternatives. A chart from a Wall Street Journal article highlighted that since the start of 2022, HEVs outsold EVs with the advantage growing in recent quarters.

HEVs have consistently outsold EVs with the gap growing.

Keep reading with a 7-day free trial

Subscribe to Energy Musings to keep reading this post and get 7 days of free access to the full post archives.