Energy Musings - April 18, 2023

Offshore Wind Is Hot - Rhode Island Only Got One Bid; Renewables Can Violate International Safety Standards; Early 2023 Hurricane Outlook Is Positive; EPA Takes America Back to Early 1900s

Offshore Wind Is Hot - Rhode Island Only Got One Bid

Last October, Rhode Island Governor Dan McKee announced a request for proposals (RFP) for offshore wind procurement in compliance with a new law. The law required the State’s primary utility company, Rhode Island Energy, to seek to contract up to 1,000 megawatts (MW) of new offshore wind generating capacity at market-competitive rates.

This offshore wind procurement has the potential to satisfy 30% of Rhode Island’s estimated 2030 electricity demand. When added to the 30-MW Block Island Wind farm and the contracted 400-MW Revolution Offshore Wind 1 project, the state will have secured about half of its projected energy needs from offshore wind.

At the time of the proposal, Interim State Energy Commissioner Chris Kearns stated: “With the release of the state’s largest offshore wind procurement RFP to date, Rhode Island is demonstrating our commitment to securing clean energy, reducing our dependence on natural gas, stabilizing long-term energy costs for consumers and capturing significant economic development and job benefits.” He went on to say, “This is a major milestone in the progress toward achieving the nation-leading 100% Renewable Energy Standard by 2033, as well as the greenhouse gas emissions reduction goals in the Act on Climate.”

Last month, Rhode Island Energy announced it had received a single bid in response to the RFP. This was surprising given the Biden administration’s high-profile push for developing an offshore wind industry. It recently released a plan to install 30 gigawatts (GW) of new offshore wind generating capacity by 2030 with another 15 GW of floating offshore wind being in the water by 2035. All to be accomplished while dramatically reducing the cost of the power produced.

Offshore wind farm construction activity is underway in New England’s waters and will ramp sharply higher this summer. Two major wind farms – South Fork Wind and Vineyard Wind - with their towering turbines will begin hammering the supporting foundations into the ocean floor this summer off Massachusetts, Rhode Island, and New York coasts.

The U.S. has two working offshore wind farms – Block Island Wind and Coastal Virginia Offshore Wind Pilot. The new wind farms will be larger and power many more homes and businesses than the operating wind farms. Those two wind farms have a combined total of 42 MW of wind-generating capacity utilizing seven turbines. The two new wind farms will have a combined 930 MW of generating capacity sitting atop 74 wind turbines, 43 of which are targeted for installation this summer.

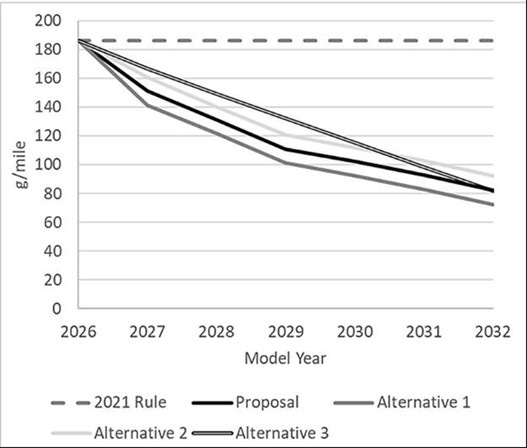

The following maps show the respective locations of the South Fork Wind and Vineyard Wind projects. The maps demonstrate how much of the waters off Rhode Island and Massachusetts will be forever altered with the addition of these wind farms, which is just the start of the offshore wind build-out.

Exhibit 1. Vineyard Wind Lies South Of Martha’s Vineyard

Source: Vineyard Wind

Exhibit 2. South Fork Wind Is Southeast Of Block Island

Source: South Fork Wind

The two wind farms will use different wind turbine designs provided by different manufacturers, although all the turbines will be built in Europe because the U.S. does not have a local supplier. To capitalize on the stronger offshore winds at higher elevations, the turbines will be much taller than onshore wind turbines. The following chart shows the height of a typical onshore wind turbine, the height of the tallest one, and the height of the new General Electric Haliade-X offshore wind turbines, which will be utilized by Vineyard Wind. For comparison, the chart also shows the height of the Block Island Wind turbines, the first U.S. offshore wind farm installed in 2016. The South Fork Wind Farm plans to use an 11-MW Siemens Gamesa turbine, whose dimensions place it between the Block Island Wind and the Haliade-X turbines. By including sketches of popular landmarks, readers may more easily relate to the scale of these new offshore wind turbines. It also explains why coastal residents want the turbines located farther offshore, hopefully over the horizon where they will not be visible from shore.

Exhibit 3. Offshore Turbines Are Growing Larger

Source: GE, Vox

With its nearly 900-foot height and 350-foot rotor blades, the length of a football field, the new Haliade-X turbine is projected to have a capacity factor of 63%, which is higher than existing offshore wind turbine models that generally have capacity factors around 45%. Larger wind turbines are key to improving the economics of offshore wind farms, but they are unproven and require even larger areas.

The capacity factor of an electricity-producing power source is a key input for calculating the “levelized cost of energy” (LCOE). That is because the LCOE of an energy-generating asset can be thought of as the average total cost of building and operating the asset per unit of total electricity generated over an assumed lifetime. By utilizing higher capacity factors – 50+% versus 45% - the projected cost of electricity can be reduced making that energy source cheaper than alternatives. This is important in the current environment of rising raw material costs and higher interest rates impacting renewables’ cost of capital.

Proponents of offshore wind point to the days when wind energy reached 65-85% utilization, appearing to offer the prospect of supplying all the electricity needed for the economy from renewable energy. However, the high utilization factors exist for brief periods and are never sustained. The power sources consistently generating high utilization rates are fossil fuel-powered plants. That is because they can deliver their power constantly, except temporarily when they need maintenance, repair, or refueling.

We come back to the question of why there was only one bid in response to Rhode Island Energy’s RFP if offshore wind is desirable (politically) and key to decarbonizing our economy. Was it because inflation and high-interest rates caused developers to hesitate over whether they could earn a reasonable profit? This issue has moved front and center as the CEOs of two major European oil companies rushing to develop renewable energy businesses, especially wind energy, pulled back because of the poor returns of projects.

Moreover, Shell’s CEO stated his company will not use the profits from its fossil fuel businesses to subsidize renewable energy projects. Shell’s renewable business is a partner in an East Coast offshore wind farm development and has indicated it is having profitability issues but will continue with the project. That decision may have been caused by the Massachusetts Public Utility Commission’s approval of utility Power Purchase Agreements over developer Avangrid Renewables’ objections. It argued the project is “unfinanceable at current prices.”

The single response to the Rhode Island Energy RPF came from the partnership of Danish wind developer Ørstad, who owns the Block Island Wind farm, and New England utility Eversource, who previously partnered with Revolution Wind 1. Revolution Wind 1 is contracted to provide 400 MW of the wind farm’s 704 MW of capacity to Rhode Island Energy. The Ørstad partnership offered 844 MW of power from Revolution Wind 2 to be developed adjacent to Revolution Wind 1. Terms of the proposal have not been made public and are not expected to be disclosed until June.

Dave Bonenberger, president of Rhode Island Energy, said in a statement: “Although we had hoped to see more developers put forward additional proposals within this appeal, we also know there are a multitude of factors at play right now.” He did not enumerate the issues, but he went on to say: “As we move forward, our evaluation will consider future energy affordability and how this proposal meets the requirements of both the RFP and state law.”

We recently obtained a copy of the JOINT DEVELOPMENT AGREEMENT [JDA] BETWEEN THE STATE OF RHODE ISLAND AND DEEPWATER WIND RHODE ISLAND, LLC. Deepwater Wind (DWW) developed the Block Island Wind farm, which started operating at the end of 2016. It was sold to Ørstad in 2018 for $510 million. The project had an estimated cost of $300. The JDA may contain clues as to why only one proposal was submitted and that from an Ørstad partnership.

Under the Definitions section of the JDA are the following details:

T. Phase I of the Project (“Phase I”) – A wind power project to be located in state waters having approximately twenty (20) MWs of nameplate capacity and interconnected to both the electric power systems of BIPCO [Block Island Power Company] and mainland Rhode Island.

U. Phase II of the Project (“Phase II”) – A wind power project to be located within the SAMP [Special Area Management Plan] area in United States waters off of the coast of Rhode Island having approximately three hundred eighty-five (385) MWs of nameplate capacity and interconnected to the electric power systems of mainland Rhode Island, and which, in the event Phase I is Discontinued, is also interconnected to the electric power system of BIPCO.

According to the language above, DWW, now Ørstad, has a monopoly on offshore wind power development for Rhode Island until the company has built a project with at least 385 MW of power. What does this agreement mean for power pricing? Was Rhode Island Energy unaware of the terms of this agreement between Ørstad and the state, or was the company thinking that because the 400 MW of Revolution Wind 1 had been contracted the monopoly was ended? Maybe the bigger question is whether the unsettled economics of offshore wind as demonstrated by Avangrid Renewables’ effort to seek adjustments to power contracts already signed has developers wary of making proposals.

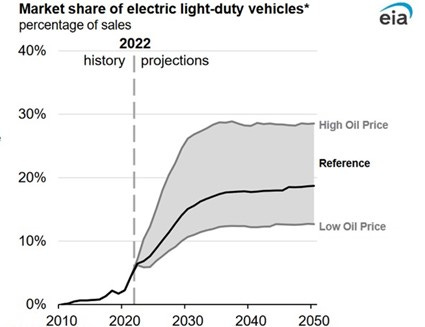

National Grid, the predecessor to Rhode Island Energy, invested in the installation of a submarine cable between Block Island and the Rhode Island mainland to transport surplus power from the Block Island Wind farm, while also allowing possible shipment of electricity to the island if needed. As the map below shows, the location of Ørstad’s Revolution Wind 1 and 2 projects allows for power cables to easily connect with Block Island and its submarine power cable to shore.

Exhibit 4. Revolution Wind Strategically Located Near Block Island

Source: Revolution Wind

Until June when Rhode Island Energy will disclose the details of the Revolution Wind 2 bid, we have no idea what electricity price the developers seek. How will the price be evaluated? We guess the price will not matter as the utility is under a mandate to contract offshore wind power. Our conclusion is based on the history of Block Island Wind’s power price evaluation by the Rhode Island Public Utility Commission (PUC). After the PUC rejected the initial submission, the Rhode Island legislature rewrote the rules that allowed for evaluating the economics of offshore wind projects. No longer can the PUC perform a “cost/benefit” analysis. Thus, Block Island paid over 24 cents per kilowatt-hour with a guaranteed 3.5% annual price increase for the 20-year life of the contract for the wind farm’s power when electricity onshore was priced at a quarter to half the price. Because Block Island’s electricity was very expensive because it was produced by diesel generators, the high electricity price still represented a discount.

Ørsted and Eversource continue saying Revolution Wind 1’s construction is expected to begin later this year and “be operational in 2025.” The problem is the project has yet to receive its final Environmental Impact Statement (EIS) from the Bureau of Ocean Energy Management (BOEM). When the draft EIS was exposed for public comment, there were 123 comments and objections. Included in the comments and objections were ones from fishery management councils, the Rhode Island Department of Environmental Management, and NOAA Fisheries. They were all suggesting changes or enhancements to the project. The final EIS will trigger additional review by the Rhode Island Coastal Resource Management Council and potentially generate lawsuits from objectors and commentators who feel the changes mandated by the final EIS are insufficient.

Since Revolution Wind 1 was proposed in 2020, wind turbine manufacturers have reduced their capacity due to the hundreds of millions of dollars of losses they have incurred as raw material inflation has overwhelmed the contracted prices for wind turbines. These challenges have not been fully corrected. Additionally, issues with increasing whale deaths could slow or derail projects despite government agencies claiming there is no linkage between offshore wind activity and a rise in whale deaths. (A topic for another article.)

Is it still realistic to think Revolution Wind 1’s timetable can be maintained? With each delay, the construction timeline will begin to possibly interfere with the work schedules of other offshore wind projects and the availability of installation vessels. Every delay impacts offshore wind farm construction costs and squeezes profit margins. Could we see more developers seeking rate relief given the sharply rising costs? Or is the Rhode Island RFP single bid a sign that despite clean energy mandates, few offshore wind developers will bid on projects, helping support higher prices for the winning bidders? In either case, more expensive offshore wind will drive average electricity prices higher. How many Rhode Islanders understand that reality?

Renewables Can Violate International Safety Standards

We were shocked to learn of waivers granted to cargo carriers hauling offshore wind turbine components allowing them to circumvent international maritime safety standards. On April 4, 2023, the Commandant of the Coast Guard issued a Marine Safety Information Bulletin (MSIB). The bulletin, MSIB: 04-23, was titled: “Reduced Visibility from the Navigation Bridge.” The Coast Guard Commandant wrote:

An increasing number of break-bulk and retrofitted bulk carriers are arriving in the U.S. carrying wind turbine parts stowed in a manner that substantially limits visibility from the navigation bridge. Many of these vessels were issued dispensation letters by their flag administration or recognized organization that temporarily exempted compliance with the International Convention for the Safety of Life at Sea (SOLAS) 1974 Chapter V, Regulation 22, which specifies requirements regarding navigation bridge visibility standards.

In some cases, flag administrations have issued dispensations of SOLAS V/22, despite the vessel’s intended voyage requiring substantial transit within restricted navigational channels and confined inland waterways with congested maritime traffic.

SOLAS is one of the most sacred regulations embraced by companies with any involvement in the maritime sector. It drives maritime company health, safety, and environmental programs. However, the only way to get offshore wind turbine components – blades and towers – from Europe to the United States, and elsewhere, is to load these ships in a potentially unsafe and dangerous way. Not only are the ships and their crews put at risk but other vessels and even coastal waters and ports are at risk because the ships are allowed to operate in a manner that violates safety standards.

Exhibit 5. Wind Turbine Components Loaded On Breakbulk Carrier

Source: americas.breakbulk.com

The Commandant must enforce the navigation and safety rules for United States waters, so he warned the ship captains. “Dispensation letters issued by flag administrations or recognized organizations do not exempt vessels from complying with corresponding U.S. requirements on navigation bridge visibility found in Title 33 Code of Federal Regulations (CFR) § 164.15. Operators of vessels that do not comply with U.S. regulations for navigation bridge visibility must notify the local U.S. Coast Guard Sector before the vessel enters U.S. waters and request to deviate from the rule.” In other words, these vessels hauling turbine components will not be given a complete pass on following U.S. navigation rules, even though they are working in support of our climate agenda.

The Commandant reminded everyone in the maritime industry and the public in general that “The U.S. Coast Guard does not typically grant deviations for situations intentionally counter to the regulations or solely for convenience or financial incentive.” We thought that statement was telling. In the name of green energy, it appears everyone else is willing to violate long-standing international rules. Fortunately for us, the Coast Guard Commandant was not quite as willing to put Americans and others at risk of unsafe ship operations.

This navigational relief appears to be merely the latest favorable treatment afforded the offshore wind industry. The number of permissions being granted to offshore wind developers allowing them to harass or possibly kill marine mammals during their construction activity is shocking. Virtually every planned wind farm is seeking relief from mammal harassment and possible death, and then they receive extensions of earlier relief when the time runs out. We are told developers are rushing to obtain “takings” approvals because they believe the National Ocean and Atmospheric Administration may have to stop being so generous given the uptick in whale deaths, and now dolphins in East Coast waters where offshore wind farms are being constructed.

Early 2023 Hurricane Outlook Is Positive

The scientists at the Colorado State University (CSU) Department of Atmospheric Science released their first assessment of the upcoming Atlantic basin tropical storm season. Subsequent forecasts will be released on June 1, July 6, and August 3, with a final wrap-up of the season on November 30.

CSU sees 13 named storms, six hurricanes, and two major hurricanes in 2023 reflecting “slightly below-average activity.” A typical hurricane season, running from June 1 to November 30, sees 14 named storms, seven hurricanes, and three major hurricanes. The details of the current forecast with the averages for 1991-2020 are shown below. A meaningful metric is Accumulated Cyclone Energy, as noted being “a measure of a named storm’s potential for wind and storm surge destruction.” For 2023, CSU sees this metric at 100, or only 81% of the 123 average number for 1991-2020.

Exhibit 6. CSU 2023 Hurricane Forecast vs. Average Season

Source: CSU

Last year, the Atlantic basin experienced 14 named storms with eight becoming hurricanes. Hurricane Ian, which struck Florida, among other places along the U.S. coastline, caused an estimated $112.9 billion in damage, according to the federal government’s National Centers for Environmental Information. It was the third costliest storm on record, after 2005’s Hurricane Katrina which struck Louisiana and Mississippi, and 2017’s Hurricane Harvey which impacted the upper Texas Gulf Coast and southwest Louisiana.

CSU’s 2023 forecast reflects a “larger-than-normal uncertainty” because of evolving atmospheric conditions. The forecast is based in part on expected conditions related to the development in the South Pacific Ocean of the El Niño weather phenomenon. El Niño is associated with warm and frequently wet weather that is also associated with stronger-than-normal winds in the upper atmosphere that can weaken developing hurricanes in the Atlantic basin. If El Niño fails to develop or is much weaker than currently anticipated, the hurricane-destroying sheer winds may not emerge, leading to a more active upcoming storm season. Regardless of whether the 2023 storm season is less active or above average, people along the coast should always remember that it only takes one storm to destroy their area.

EPA Takes America Back To The Early 1900s

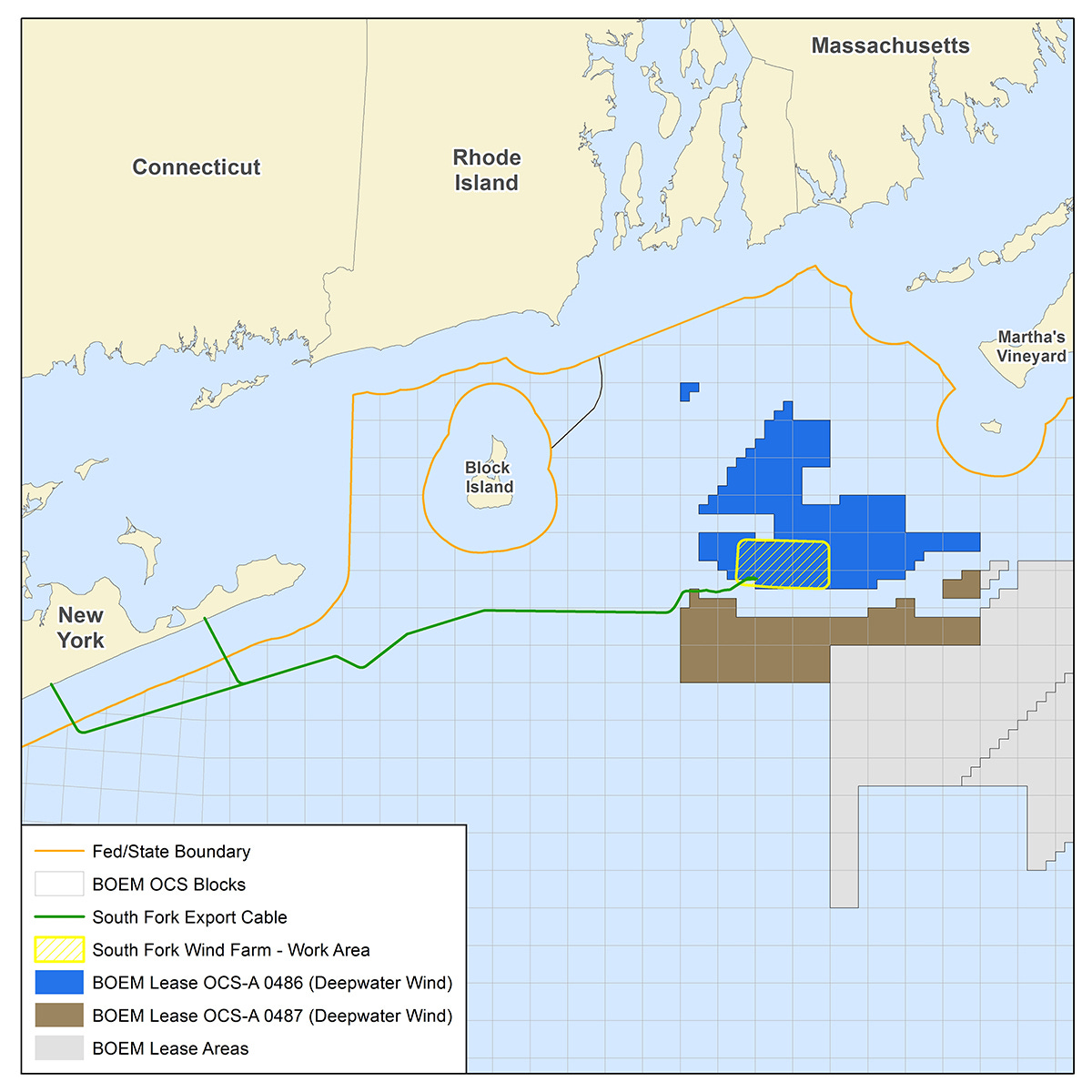

Last week, the Environmental Protection Agency (EPA) issued proposed new vehicle fuel-economy rules that would start with the 2027 model year and phase in tightened standards each year until 2032. In terms of the agency’s goal, the following chart comes from the EPA summary of its nearly 700-page Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles filing. The chart shows that for greenhouse gas emissions, the new standards would reduce the target for the industry-wide average light-duty vehicle fleet emissions from 186 to 82 grams per mile between 2027 and 2032, a 56% reduction. While the chart shows that the EPA has proposed several alternative scenarios, they all are projected to achieve meaningful emission reductions by 2032.

Exhibit 7. How EPA Wants To Cut Auto CO2 Emissions

Source: EPA

According to the EPA’s summary, in a section labeled “Projected Mix of Technologies,” it discussed a possible pathway for the automobile industry to meet the proposed standards. This is why the EPA’s announcement triggered a response that this is an administrative plan to push Americans into having to buy electric vehicles (EV). As you will see below, pushing EVs on Americans is just one of several possible plans set forth. Highlighting it in the summary report (which is all the mainstream media will read) was trumpeted as the greatest climate change policy action of the Biden administration. The EPA writes:

The proposed standards are performance-based, allowing each automaker to choose what set of emissions control technologies is best suited for their vehicle fleet to meet the standards. EPA projects that one potential pathway for the industry to meet the proposed standards would be through:

Nearly 70 percent BEV penetration in MY 2032 across the combined light-duty passenger car, crossover/SUV, and pickup truck categories

About 40 percent BEV penetration by 2032 across the combined medium-duty van and pickup truck categories

Wide-spread use of gasoline particulate filters to reduce PM emissions

Improvements in technology to reduce CO2 from conventional gasoline vehicles

Manufacturers may also choose to employ hybrid or plug-in hybrid technologies to help meet the proposed standards.

Understand, this suggested pathway would lead to roughly two-thirds of all new vehicle sales for 2032 having to be electric as that would be the only way auto manufacturers would be able to meet the emissions reductions legislated. If they fail to meet the fuel-efficiency standard, they must buy emission credits from companies in compliance such as Tesla to comply. The price of credits would add to vehicle costs, something the government suspects companies wish to avoid their models becoming less competitive. Americans, unfortunately, would face a challenge to buy a gasoline- or diesel-powered vehicle, which is the goal of the Biden administration’s plan.

The EPA has also proposed tightened emissions standards for heavy-duty trucks. The agency also provided a possible pathway for truck manufacturers. It suggests electrifying a large portion of truck sales in future years to meet the tightening standards. The EPA wrote:

50 percent ZEVs [zero emission vehicles] for vocational vehicles in MY 2032, which includes the use of battery electric and fuel cell technologies.

34 percent ZEVs for day cab tractors in MY 2032, which includes the use of battery electric and fuel cell technologies.

25 percent ZEVs for sleeper cab tractors in MY 2032, which primarily includes the use of fuel cell technologies.

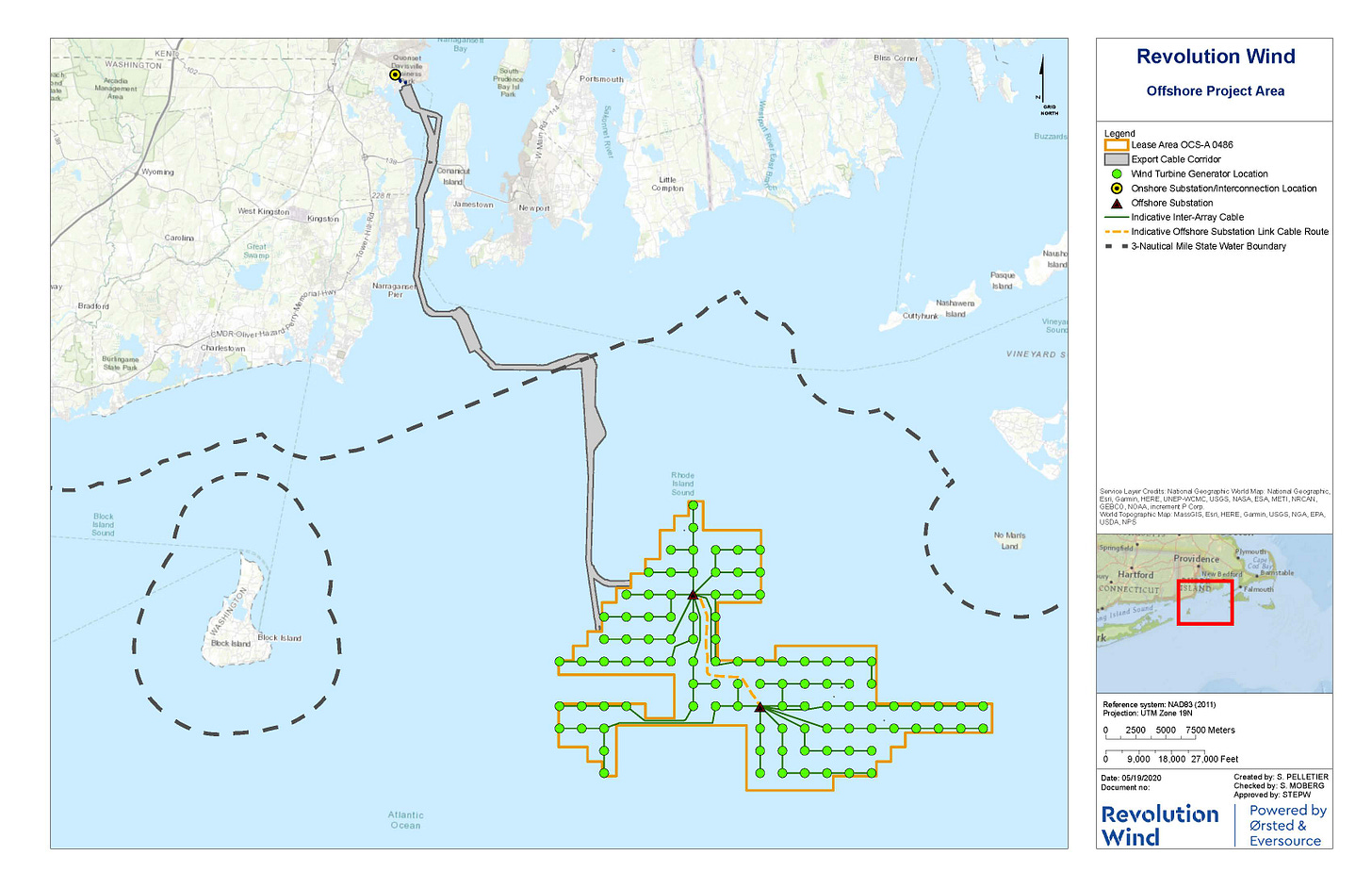

Presently, the Energy Information Administration arm of the Department of Energy is projecting EV sales to only be about 15% of total sales by 2030 in its latest Annual Energy Outlook. Even in its most optimistic scenario, which was prepared before the EPA proposed the new standards, EV sales never reach 30% in any year to 2050.

Exhibit 8. EIA Is Not As Optimistic About EV Sales

Source: EIA

The last time EVs dominated the U.S. automobile industry was in the early 1900s. At that point, EVs accounted for over a third of new car sales. EVs dominated because they were easier to operate, homes were beginning to be electrified, which made it easier to recharge batteries, and the road system was limited so people did not travel far. Thomas Edison believed in EVs and began working on a new model with his friend Henry Ford. But the development of the electric starter made starting a gasoline-powered car easier, especially for women, and Ford’s assembly line put the cost of his Model T within the reach of the average American. In 1911, a Model T cost $650 while an electric roadster cost $1,750. We know how this story played out.

So, what new technology does an EV offer that further improvements in the efficiency of internal combustion engine (ICE) vehicles cannot offset? People forget that EVs generate 70% more carbon emissions than their comparable ICE model when built. The EVs’ emissions savings come from driving it – it has no tailpipe emissions. The legacy emissions of an EV are offset by years of driving. How many years or miles need to be driven to reach parity with the cumulative emissions of an ICE vehicle depends on how clean or dirty the electricity generation is that is charging the EV’s battery.

The large amount of expensive minerals used in building an EV makes them considerably more expensive than ICE vehicles. The government’s solution is subsidies. Still, auto manufacturers are losing billions of dollars in building EVs, with future profitability several years away, at best. That scenario was outlined by Ford Motor’s CEO Jim Farley recently but reaching profitability – single-digit profit margins – is highly suspect.

A recent Wall Street analyst recommendation of GM’s stock was interesting. After extolling positive business developments at GM, the analyst wrote, “but a transition from a PROFITABLE ~98% ICE portfolio to an EV portfolio (negative ~15-30% gross margin) poses significant challenges.” No kidding.

The ability of the automobile industry to ramp up its EV manufacturing capacity to meet President Joe Biden’s August 2021 target of 50% of auto sales in 2030 being EVs was acknowledged to be a challenge. Now, the EPA’s greenhouse gas emissions standard will increase Biden’s target by 30% in just two more years. Whether that is physically possible is in doubt, at least if we believe the comments from auto industry executives. Factories need to be built, raw materials must be contracted, supply chains need to be structured, and workers need to be hired. All these steps require time, yet the Biden administration is mandating it all be done in 7-9 years.

Another problem hindering this EV revolution is that public attitudes are not helpful. Two recent polls of public attitudes toward EVs are revealing. The Energy Policy Institute at the University of Chicago, together with the Associated Press and NORC Center for Public Policy Research, conducted a poll designed to discover what Americans are thinking about climate change along with their attitudes toward EVs. Four of ten people surveyed said their next car might be an EV. That is consistent with the latest Gallup poll results. Although it showed only 4% of Americans own an EV and only 12% are “seriously considering” buying one, 43% said they might consider buying an EV sometime in the future. Some 41% of respondents unequivocally said they would not buy one.

Gallup also sought Americans’ perceptions of EVs as helping climate change. The results showed 12% think they will help “a great deal” and 27% said they would help “a fair amount.” However, 35% said EVs would help “only a little” and 26% said “not at all.”

Although not questioning people about EVs and climate change, the AP/NORC poll did ask about climate change. In 2017, 57% of those responding said that climate change is caused entirely or mostly by human activity. However, in a recent poll, the number is down to 49%. The percentage of people who said that climate change is an important issue rose from 22% in 2017 to 28% in 2023. This contrasts sharply with the monthly polling conducted by Gallup of Americans’ most important concerns. The average of Gallup’s 11 monthly polls conducted in 2022 showed the environment finishing last of the 14 concerns identified. It garnered a 3% response rate.

The latest Gallup’s “most important concerns” trend covering the monthly surveys of August 2022, September 2022, October 2022, December 2022, January 2023, February 2023, and March 2023 showed environment/pollution/climate change having 3%, 3%, 4%, 3%, 3%, 3%, and 2%, respectively. We find this poll instructive because it comes from asking Americans to name their most important concerns rather than pollsters questioning participants about their concerns about climate change or the environment.

The Biden administration’s push for EVs seems to be driven by ideologues with an agenda focused on climate change. Little about the physical realities of transitioning the U.S. vehicle fleet from fossil fuels to electricity appears to have been considered. How long does it take to create new supply chains for batteries, including the mines and processing plants? The International Energy Agency tells us it takes 16 years on average from ore discovery to a mine’s initial production. EV drivers continue struggling with inadequate and expensive charging networks, and EVs still suffer when operating in cold weather. Energy transitions take decades. The EV transition is just a slight variation of an energy transition. The Biden administration believes it can be done in a handful of years, which is a fantasy. Electricity costs are about to soar as the demands from an electric vehicle fleet will drive consumption up. Higher electricity costs will harm all Americans.