Energy Musings - April 17, 2024

The media has been interviewing the CEO and chairman of Shell Oil who are frustrated with the valuation of their stock. They wonder whether the problem is being listed in Europe rather than the US.

“Looking For Love In All The Wrong Places”

Shell Oil management is seeking love. Are they looking in the wrong places? The media continues to recycle this story. Our question comes from the song recorded by American country music singer Johnny Lee in 1980. It headlined the movie Urban Cowboy, which revived John Travolta’s career and introduced moviegoers to Debra Winger. The movie “launched a country-music crossover groundswell” in the U.S., according to USA Today in 2020 on the film’s 40th anniversary. Lee was the lead act at Mickey Gilley’s club in “blue collar” Pasadena, Texas, which featured the mechanical bull that starred in the movie.

Wael Sawan, Shell’s CEO, and Ben van Beurden, the company’s chairman and past CEO, have been interviewed recently about their disappointment with their stock’s low valuation, especially compared to non-European international oil companies. In the interviews, the executives described the stock as being “massively undervalued.” Then again, what management believes their share price accurately reflects the company’s worth?

The valuation issue surfaced last fall following revelations by the Financial Times of Shell’s deliberations over leaving the Netherlands and moving to London. The gist of the interviews about Shell’s stock being undervalued compared to its American peers questioned its European stock listing. However, maybe there is another issue.

European international oil companies are valued below the American companies.

The June 2023 FT article included the chart above. It shows the ratio of the then-current share prices divided by the consensus of the companies’ 12-month forward cash flow estimates. The chart showed the current ratio is below the five-year and 10-year averages. More stunning is the comparisons of the European-listed and based international oil companies to their American-based competitors.

Shell’s stock price has begun to perform better but still not as well as management believes it should.

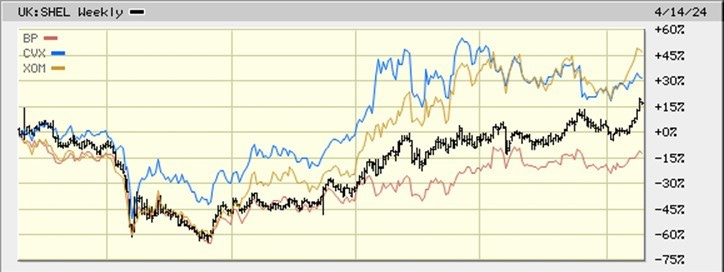

A chart of the 2019-2024 performance of Shell’s share price compared to fellow London-based BP and American competitors ExxonMobil and Chevron shows how this valuation disparity has impacted shareholder returns. As international oil companies, all the share prices are impacted by global oil market developments and investor sentiments toward fossil fuel investments.

The chart above shows the performance of these four stocks for the past five years. Note that Shell initially tracked Chevron until about mid-2019. All the companies suffered during the oil market collapse at the outbreak of the pandemic in early 2020, but Chevron’s recovery set it apart from the group during the balance of 2020. In 2021, ExxonMobil began outperforming Shell and BP while tracking Chevron’s gains. Was that revival a result of ExxonMobil losing its proxy battle with activist Engine No. 1?

At the start of 2022, Shell began outperforming BP, and by mid-year, ExxonMobil had caught up with Chevron. The race since then has been between ExxonMobil and Chevron, with the former breaking into the lead in 2024. At the same time, Shell’s stock price experienced a significant upturn.

Keep reading with a 7-day free trial

Subscribe to Energy Musings to keep reading this post and get 7 days of free access to the full post archives.