Energy Musings - April 1, 2025

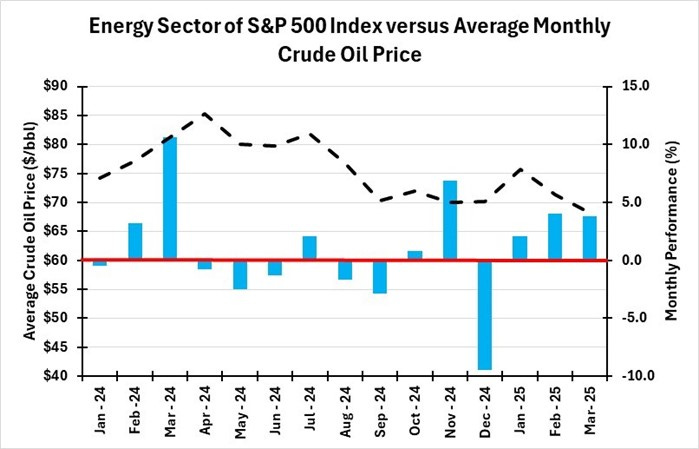

The energy sector of the S&P 500 was the top performer for March. It was one of only two sectors posting gains for the month when the market dropped over 4%. Better oil prices helped the gains.

Energy Tops The S&P 500 Sector List

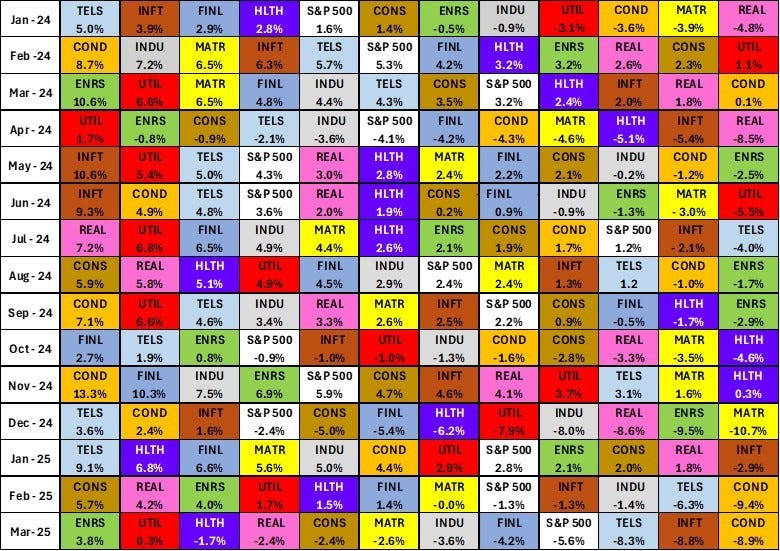

Energy was the best-performing sector of the S&P 500 in March. It was one of only two sectors that posted positive performance for the month, the other being utilities. For the entire first quarter of 2025, energy led all sectors, with a gain of more than 10%. This monthly and quarterly performance occurred in a stock market that posted its worst quarter since 2022, with a decline of 4.3%.

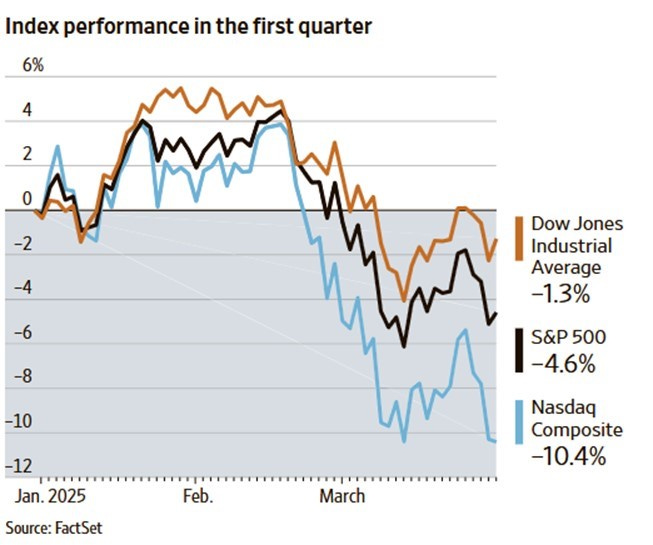

The Wall Street Journal’s print edition today led with the story of the stock market’s dismal first quarter, accompanied by a chart illustrating the poor results across all markets. The writer suggested that tariff uncertainty and its impact on economic growth were the primary reasons for the dismal results. She indicated that these market dynamics were driving some investors to seek opportunities abroad.

Europe has been a popular hunting ground for investors, driven by the sudden surge in government fiscal stimulus following President Donald Trump’s threats that NATO members needed to increase their military spending and support for Ukraine in its battle with Russia. Around the world, China has also offered better economic prospects for many of its businesses, which has attracted investment flows.

More technology-oriented stock market indices performed worse.

As the chart illustrates, the stock market performed well for the first half of the quarter. It was in early February that the tariff news began to overshadow all other economic news. The tariff battle triggered geopolitical concerns. With tariffs acting as a tax, creating significant uncertainty about company supply chains and their ability to pass the costs on to consumers, talk of a recession surfaced. Recessions are not good for stocks.

Despite the recession fears, the geopolitical fallout has provided some relief for energy markets. Energy stocks have also benefited from their years of financial discipline. Therefore, while earnings might decline with lower oil prices, the de-levered balance sheets of energy companies provide financial support. Investors have greater confidence that energy companies are not likely to go bankrupt. Additionally, energy company dividends and stock buybacks were probably safe, although the latter might be scaled back due to reduced free cash flows. Offsetting that concern is the possibility that lower stock prices could enable companies to continue achieving their share buyback targets despite having less cash available.

Energy gets back to the top of the sector performance list.

Looking at the last 15 months of S&P 500 sector monthly performance, we initially were struck by energy topping the list for March. We then noted that the previous time energy was at the top was exactly a year ago, in March 2024. Following that peak performance, energy stocks began their swoon as oil prices started to drop amid concerns about prolonged economic weakness and an oversupplied global oil market.

Energy hit its bottom in May 2024 and was among the lowest-performing sectors (in the bottom three) for five of the remaining eight months of the year. Things began to improve for energy in January 2025 and have continued to improve progressively, leading to its top ranking in March.

Energy’s stock market improvement has been driven by higher oil prices, even as the overall market has been hammered by the tariff and recession uncertainty. The spot oil price on March 3 was $68.63 a barrel. Prices continued to slide for another week, bottoming at $66.31. The price closed Monday at $71.48.

Oil prices impact energy stocks, but aren’t the only factor.

The primary driver of higher oil prices has been the Trump administration’s imposition of additional sanctions on people and companies that have helped Russia and Iran evade the sanctions on their oil exports. The sanctions are impacting Russian and Iranian oil shipments to China’s small refiners, potentially causing those volumes to shrink, which could open up market space for more OPEC oil and even U.S. exports. These market-moving events foreshadow further global oil market tightening and higher sustained oil prices. After energy’s dismal stock market performance last year, could 2025 be a good year?