Energy Musings - April 1, 2024

The stock market rotation we wrote about is continuing with the Energy sector posting the best performance for March. For Q1, Energy outperformed the S&P 500, driven by higher oil prices.

Energy Is Back On Tops!

Wow! The Energy sector of the Standard & Poor 500 Index was the best performer for March racking up a 10.6% gain for the holiday-shortened month. It has now posted consecutive monthly gains following four months of losses.

Energy is back in first place after a five-month absence. Although the S&P 500 had an outstanding quarter by posting a 10.6% gain, Energy was the second-best performing sector, up 13.7%.

Energy topped the S&P 500 sector performance for March after months in the bottom half.

After five consecutive months of trailing the performance of the S&P 500 Index, Energy more than tripled the Index gain in March and posted a 30% better performance for the first quarter. We recently wrote about a stock market rotation underway, driven by a changed economic reality. It means the stock market of the past will not be the future stock market. Why? Because inflation will be higher than anticipated, and interest rates must stay higher for longer. Moreover, the green energy mandates, backed by government subsidies, will support inflation and the need for higher interest rates. Soaring government debt further adds to the inflationary pressure.

Last Friday’s Wall Street Journal article highlighted the quarterly gains for the stock market and technology stocks. However, the Magnificent Seven stocks are quickly becoming known as the Lagging Seven. And the Magnificent Seven has just become Five as Apple and Tesla shares got hammered during the quarter. But as we have written, a stock market rotation is underway, and the top four sectors (see chart above) in March were Energy, Utilities, Materials, and Financials – groups that prosper under different market conditions that existed for most of 2023.

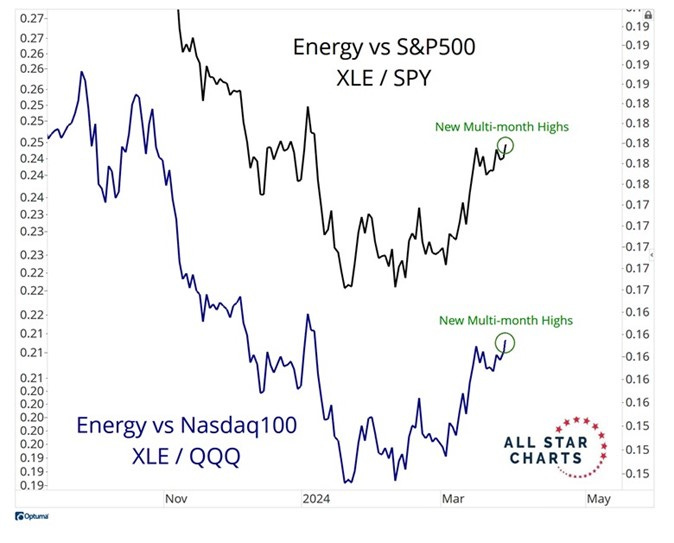

Here is what the market is showing. The first chart from J.C. Parets of All Star Charts shows two graphs: the Energy ETF versus the S&P 500 Index and the Nasdaq. Both ratios show multi-month highs, confirming Energy stocks outperforming the overall market. However, you are hard-pressed to hear about this from the anchors on the various daily stock market shows. They still want to talk about the latest Artificial Intelligence investment play.

Energy at multi-month highs versus the overall stock market confirm a sector rotation underway.

The following chart explains what is behind the performance revival of Energy. Crude oil futures prices are suddenly doing better than investors anticipated. Rising crude oil prices translate into higher gasoline and diesel prices that filter through supply chains and into intermediate and final goods prices, whose increases will continue to keep inflation higher than expected. Oil, minerals, and materials investments become inflation hedges for investors.

Energy’s stock market performance is driven by better performance of crude oil futures prices.

There has been much interest lately in the rise in gold prices. Gold is often snubbed as an investment because it offers little investment return unless sold at a profit. Instead, portfolio specialists may recommend a small weighting as a risk management tool. Think of gold investments as an anchor to windward for a sailboat, which prevents it from being driven onto vessel-wrecking shoals.

Gold prices have reached the highest levels ever. But as the following chart shows, it isn’t just gold prices that are going up, it is copper, too. Other mineral prices are rising in concert. Again, this is another sign of support for the stock market rotation thesis.

Better gold and copper price performance points to the sector rotation being all about commodities.

If the future investment environment differs from how most investors positioned their portfolios, one must only consider what happens when their performance begins lagging. They will decide suddenly to make a change – sell technology stocks and other 2023 stock market favorites and load up on the Energy, Materials, Industrials, and Utilities stocks. When that time comes, be prepared for a wild ride.