Energy Musings - January 13, 2025

Japan is restarting nuclear reactors that were shuttered following the Fukushima accident in 2011. Restarting them is slow, hampered by upgrading needs. Japan's revival mirrors a world revival.

Nuclear Power Sentiment Shift In Japan

We were intrigued by the Energy Information Administration’s “Today in Energy” chart on its website last Friday. It shows the number of Japanese nuclear reactors restarted during 2015-2024 following the industry shutdown in response to the 2011 Fukushima crisis. While Japan’s nuclear revival is a special case, what is happening with its nuclear industry is in step with the growing embrace of this energy source by countries around the world.

The revival of Japan’s nuclear industry.

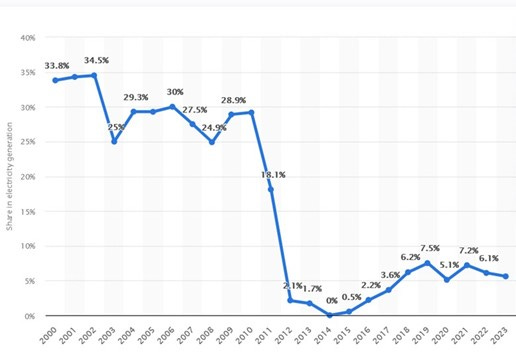

Before the March 2011 Fukushima Daiichi nuclear plant accident, following the earthquake-generated tsunami that flooded the area and plant, Japan's 54 reactors had provided more than 30% of the country's electricity. By 2014, Japan’s nuclear power output fell to zero as the industry awaited new regulations. Since then, the industry has moved to restart shutdown nuclear power plants. In 2023, Japan generated 5.6% of its electricity from nuclear, which likely rose last year. While a far cry from the 30+% share of power before 2011, with more reactors restarting, Japan’s nuclear contribution should increase further. How much more will depend on Japan’s new energy policy plan, which the government is debating.

Nuclear’s share of Japan’s power rollercoaster.

The pace of the nuclear restart effort has been hampered by the need to upgrade safety features at some plants. For example, in May 2019, the Nuclear Regulation Authority (NRA) ordered Kansai Electric Power to “backfit” seven of its reactors based on a new analysis of the potential eruption of a dormant volcano, Mt. Daisen. The reactors were previously cleared in compatibility examinations based on the latest regulatory standards.

A month earlier, the NRA announced it would not extend deadlines for utilities building facilities to meet new anti-terrorism guidelines. While only affecting 10 reactors, operating reactors were temporarily shut down to make the necessary modifications.

The restart process has caused significant implementation costs ranging from $700 million to $1 billion per unit, regardless of reactor size or age. Between 2011 and 2017, the total implementation cost was estimated at 1900 billion Yen ($17 billion) for eight companies, according to a Japan Atomic Industrial Forum survey. Obviously, the number has increased over time.

To better understand the magnitude of the cost of restarting nuclear plants, the following provides a perspective, even though it is somewhat dated. “In July 2016, the Institute of Energy Economics, Japan estimated that seven reactors could restart by the end of March 2017, 12 more in the following year to March 2018, with a significant reduction in fossil fuel imports. In relation to local judicial rulings, which might hinder restarts, the report noted: ‘As a rule, if one nuclear plant with a capacity of 1-gigawatt-electrical stops operation for one year in an area where annual demand is about 100 terawatt-hours, total fossil fuel costs increase by JPY 60 billion ($537 million) and the energy-related CO2 emissions increase by four million tons. The average electricity unit cost will increase by JPY 400/megawatt-hour (+1.8%)’."

The increase in fossil fuel costs in recent years was exacerbated by the 2022 Russian invasion of Ukraine, which created an energy crisis in Europe. In response to Europe’s loss of Russian natural gas supplies, it bid aggressively for global LNG supplies, which drove up prices. The surge in LNG costs significantly impacted Asia’s natural gas market and drove up Japan’s electricity costs.

Essential for the renaissance of Japan’s nuclear power has been the public’s views toward restarting the plants. Since 2013, Asahi Shimbun, a leading Japanese newspaper, has conducted an annual poll asking about restarting nuclear plants. The chart shows that people were opposed to restarting by two-to-one in 2013. In 2023, for the first time, more than half the public supported restarting the plants. Some of that support was in response to the impact of the Ukrainian war on LNG prices, which is important to Japan’s power industry.

The Japanese public is more positive about nuclear.

This sentiment shift is in step with growing interest and action in support of adding more nuclear-generating capacity to the world’s electricity grid. This revival of nuclear support has surprised people, especially those pushing renewable energy as the only acceptable power source.

Japan’s government formulates its national energy policy periodically. That policy shifted immediately following the Fukushima accident. The power industry needed to rely on more fossil fuels initially, but the official policy embraced increased use of solar and wind power, and hydropower. That policy remains in place. It is targeted to change following the new administration’s arrival last year.

In December, Japan’s Economy, Trade and Industry Ministry presented the draft of the Seventh Strategic Energy Plan to a meeting of energy experts. The medium- to long-term policy guideline calls for using nuclear power as much as possible along with renewable energy. This policy reverses the government’s earlier resolve to minimize the use of nuclear energy. Prime Minister Shigeru Ishiba’s Cabinet is expected to approve the energy plan by February.

The plan estimates that nuclear power will account for 20% of Japan’s total energy output in 2040, about the same level projected for 2030. That would be about two-thirds of the share of the nation’s electricity generated by nuclear power before the 2011 Fukushima accident. The projection assumes that the majority of the 33 existing nuclear reactors are restarted. Plans also include the construction of more nuclear reactors, even allowing them to be added to existing plant sites.

Renewable energy offsets some of the lost nuclear energy.

What is clear from the chart is how vital nuclear power was during 1980-2010 in limiting greater reliance on fossil fuels. Japan has almost no domestic energy supplies, forcing it to import its electric generation fuels. Fortunately, adequate natural gas supplies and facilities were available to handle the increased volumes.

The chart also shows how renewables increased their contribution in response to the loss of nuclear power and the government’s revised energy policies. However, the chart also shows that natural gas and coal have been the primary fuels meeting the country’s power demand growth.

In the future, Japan will face the same demand dynamics as other countries as more data centers, semiconductor factories, and artificial intelligence power consumption will drive increased electricity use. This growth is important for the Japanese economy. More nuclear power will be needed. Japan is allowing utilities to build new nuclear plants on the sites of existing ones. That ruling should reduce the permitting time for new plants, impacting their construction time and cost by utilizing existing infrastructure.

In the meantime, by restarting nuclear reactors and increasing the share of electricity generated by nuclear power, Japan can displace imported fossil fuels. In 2023, Japan operated 11 nuclear power plants with nearly 11 gigawatts of generating capacity. The reactor restarts that year contributed to an 8% drop in LNG imports, reducing them to their lowest level in 14 years. However, that year, LNG and coal imports cost 12.4 trillion yen ($86 billion), accounting for 11% of Japan’s total import bill. This cost pressures consumers to pay higher electricity prices.

The revival of Japan’s nuclear power industry marks a significant policy change. Japanese families are suffering from higher electricity bills, which will only go higher as demand growth must be met, and utilities are dealing with renewable energy’s shortcomings in assuring electricity reliability.

Enough time has passed for the public to be less afraid of another accident and to begin embracing nuclear power to limit future electricity price increases in the face of growing demand. Japan’s nuclear power renaissance is being mirrored in many nations worldwide.